The trend cannot last forever and will eventually have to be reversed. Signs of a trend that are slowing down, pausing and changing direction are reflected in price patterns, meaning patterns are formed by prices on charts. Price models are the result of complex interactions between buyers and sellers; between resistance and support levels.

They are used to forecast the future price movements of a financial instrument. The reason for the widespread use of price models is that the evolution of prices tends to repeat. If the market responds the same way every time a price pattern appears in the past, it is likely that the market will react in the same way when that price pattern reappears. Price models are of great help in the trading decision-making process, as they help you forecast the best prices to set Stop Loss and Take Profit levels.

Here are some of the most popular pricing models in forex trading:

Double top model

The Double top pattern is also often formed at the end of an uptrend. It is one of the most popular models. The model consists of two adjacent vertices of similar height (or almost) with an average bottom between them. The neckline is drawn horizontally across the lowest points of the bottom.

This pattern is confirmed when the price breaks below the neckline after forming the second shoulder. Once that happens, the currency pair will start the downtrend. Therefore, the sell order is placed below the neckline. Calculate target price measuring distance between vertices and neckline. This distance is approximately the amount that will move after it breaks the neckline. After breaking, the neckline begins to act as a resistance. Undo action is also likely here.

Double bottom model

The Double bottom model is the exact opposite of the Head and Shoulders model. It appears at the end of the downtrend and indicates a bullish reversal.

The same pattern with 3 peaks / 3 bottoms is called Triple top / bottom. Same transaction.

Head and Shoulders - Head and Shoulders

Head-and-Shoulders pattern is usually formed at the end of an uptrend. While the uptrend is seen at the period of the continuation of prices rising to the top and bottom, the Head-and-shoulders pattern shows a weakening trend.

The model consists of a head (the second peak and the highest peak) and two shoulders (lower peak) and a neckline (the line connecting the lowest point of the two shoulders of the shoulders and representing a support level) . The neckline can be either horizontal or sloping up / down. Signals are more reliable when the slope is down, not up.

This pattern is confirmed when the price breaks below the neckline after forming the second shoulder. Once that happens, the currency pair will start the downtrend. Therefore, the sell order is placed below the neckline. To get the target measure the distance between the highest point of the head and the neckline. This distance is approximately the amount that will move after it breaks the neckline.

Note that prices often return to the neckline after an initial break (an action of "falling back"). In this case, the neckline, usually a support, acts as a resistance.

Inverse Head and Shoulders - Inverse Head and Shoulders

The inverse head and shoulders pattern is the exact opposite of the head and shoulders. It occurred at the end of the downtrend and showed a bullish reversal.

Rectangle model

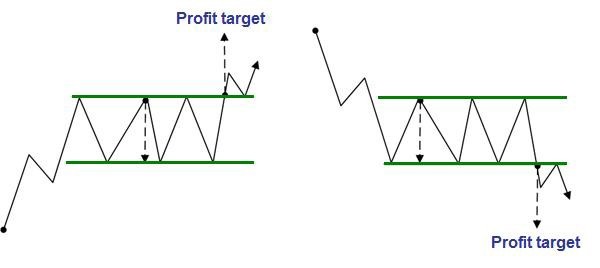

The Rectangle model describes a price model where supply and demand seem to be balanced over a long period of time. The currency pair moves in a very small range, finding support at the bottom of the rectangle and reaching resistance at the top of the rectangle. The price will eventually surpass this sideways trade. A breakout is more likely to go up, if the previous trend is up, and down, if the previous trend is down. However, Rectangle may become a reversal pattern.

Flag and Pennant pattern

These models are formed when there is a strong price movement after the consolidation period. The Flag pattern consists of 2 parallel trend lines (support and resistance) that are sloping compared to the previous trend. The Pennant model consists of two converging trend lines starting wide and converging and a very short symmetrical triangle.

Always trade in the Flag and Pennant models in the direction of the previous trend placing orders on the resistance line (for the uptrend) or the support line (for the downtrend).

Triangles model

Triangle pattern is easy to identify. The best way to trade is by breaking a trade. Trading inside the triangle is more risky and requires experience.

There are 3 types of triangle models. The ascending triangle is considered to be a rising pattern, the descending triangle is called the bearish pattern, while the symmetrical triangle - a neutral pattern.

In the case of an isosceles triangle, neither the bulls nor the bears will dominate the market. The support line slopes upward and the resistance line slopes approximately equal to each other. The break can be in any direction. One thing for sure is that it finally happened. As a result, one can place orders on lower highs and higher lows. When one command is reached, cancel the other.

The ascending triangle indicates that bulls are getting stronger as they push prices up to a level, while bears are weakening and allowing prices to form a higher low. The resistance line is relatively flat or horizontal and the support line is sloping upwards. In most cases, for now, the price will surpass resistance. Place the order above the resistance line and the higher bottom.

The descending triangle indicates that bulls are getting stronger as they pull prices down, but the bulls are weakening and allowing prices to form higher highs. The resistance line is sloping down and the support line is relatively flat or horizontal. In most cases, for now, the price will surpass resistance. Place the order below the support line and on the lower top.

0 Comments