The reversal candlestick pattern is a combination of Japanese candlestick bars that indicate a trend reversal, but care must be taken to consider the previous market trend to determine whether the pattern is bullish or bearish. Here are the 14 most popular reversal patterns in forex you should consult.

The bullish reversal candlestick pattern

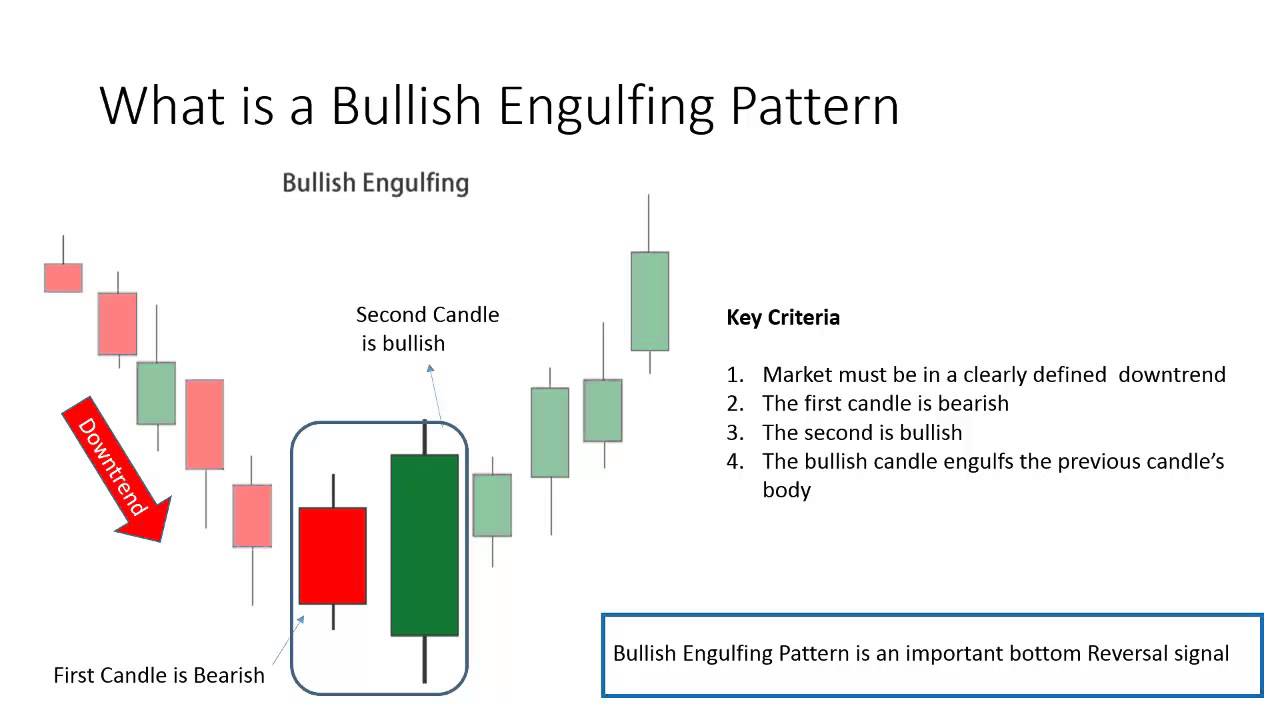

1. Bullish Engulfing (bullish candlestick pattern)

Bullish Engulfing is a pattern of two opposite candles occurring in a downtrend.

- The first day is a bearish candlestick, but it can also be a Doji.

- The second day is a bullish candle and is longer than the first day.

- The main body of the second day candle completely overwhelms the shadow of the first day candle.

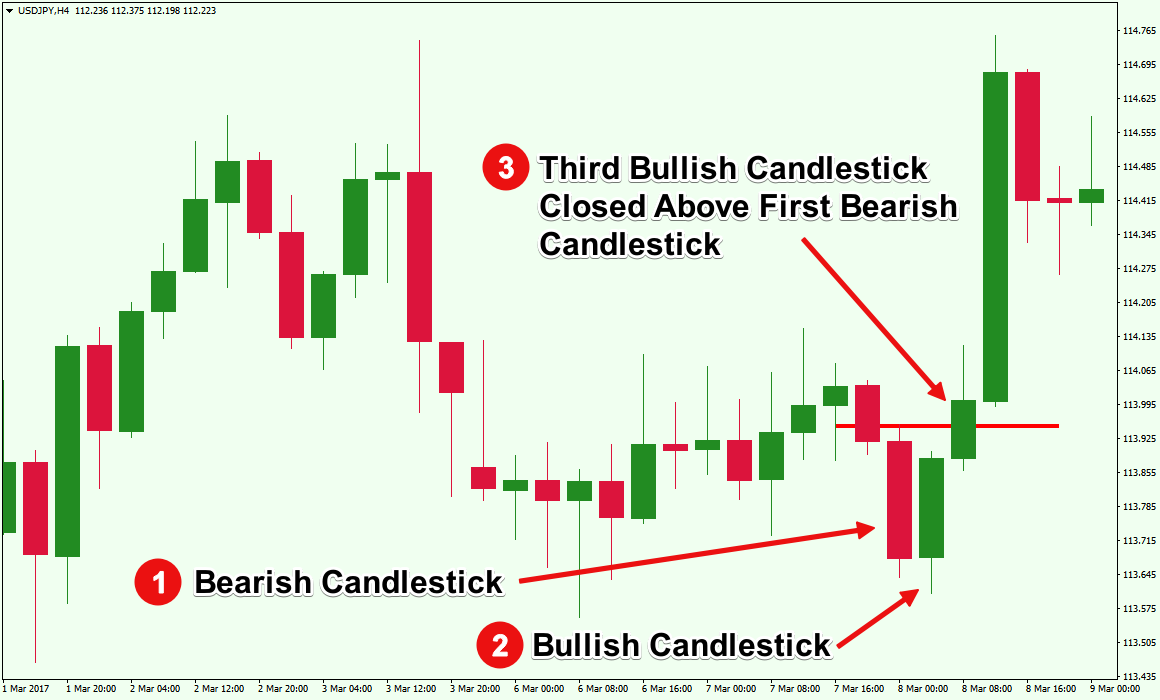

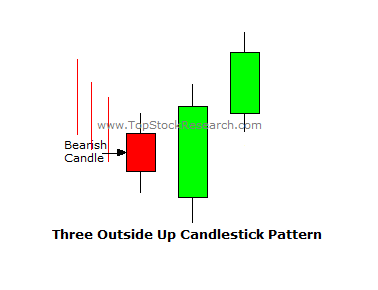

Sometimes the bullish engulf candle pattern is referred to as a three outside up pattern. The difference is that there is a third bullish candlestick and closes on the top of the second bullish candlestick.

2. Piercing Pattern (break through line)

Piercing line pattern appears in a downtrend. The first day of the pattern is a strong bearish candlestick, the second day is a strong bullish candlestick with the opening price below the lowest price of the first day and closing> 50% of the first day's real body.

3. Morning Star (morning star candle pattern)

In the morning star pattern, the first day candle is a long bearish candle, the second day has a small body + the gap falls (the opening price of the second candle is lower than the closing price of the first day) and the third day is rising sharply. The second day candle could be a Doji candle. It is better to have a gap between the 2nd and 3rd candles.

4. Hammer hammer pattern

Hammer hammer candles are small body candles with long lower shadows (at least twice as long as the body

main candle). A hammer candle appears in the downtrend and signals the market has reached the bottom, showing signs of reversal. Normally, the color of the candle does not matter, so does the upper shadow even though the shadow may be small or not even appear.

5. Three Inside Up (pregnant women hold their babies)

Three Inside Up is a Bullish Harami pattern that confirms a bullish reversal with candle 1 being a bearish candle with a large real body; The second day is a bullish candlestick with a small real body opening and closing within the real body of the first day; The third day is a bullish candlestick that closes above the first day's candle.

6. Three Ouside Up

Three Outside Up is a Bullish Engulfing pattern that has a bullish confirmation with the third bullish candle, which adds to the model's reliability. The Three Outside Up candlestick pattern consists of 3 candles in which the first candle is a bearish candle, followed by a strong bullish candlestick that covers the entire first day candle, forming the Bullish Engulfing pattern. The third day is a bullish candlestick that creates a new high.

7. Three White Soldiers (3 white soldiers)

Three White Soldiers are a three-candle candlestick pattern that signals bullish reversals that often occur in areas of declining prices and warns of a possible rebound. The open - close - high - low price of each candle must be higher than the previous candle and the close price is close to the high price of each candle.

The bearish reversal candlestick pattern

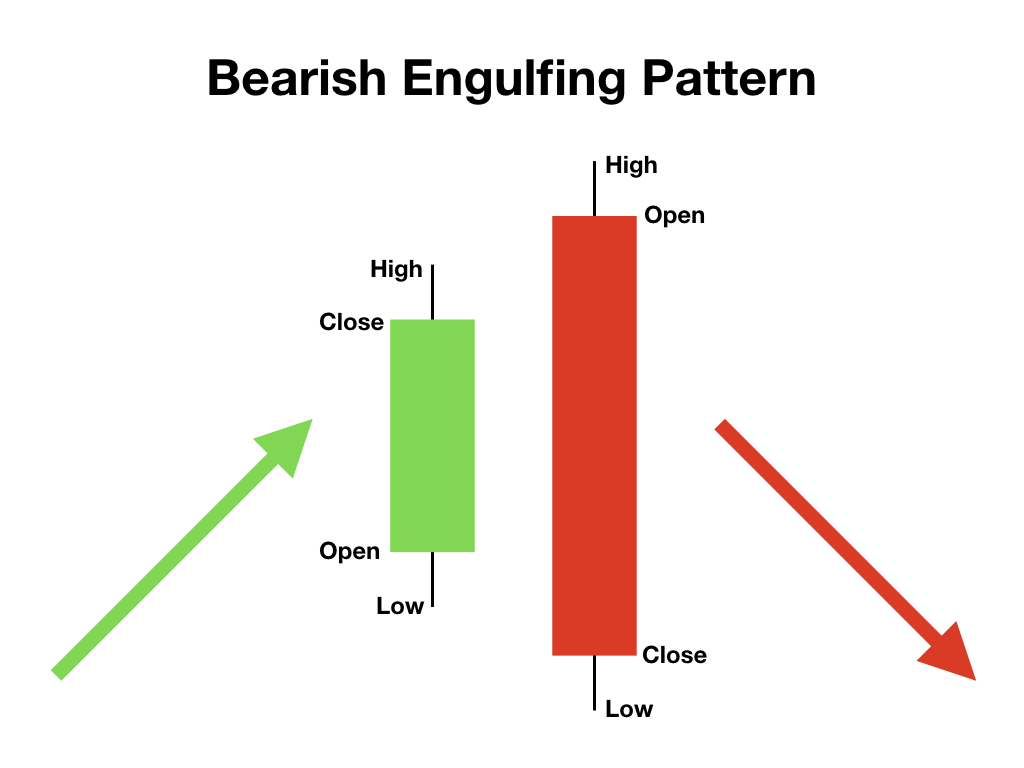

1. Bearish Engulfing (bearish engulfing candle pattern)

Conditions of Bearish Engulfing model are:

- The first day is a bullish candle, but it can also be a Doji.

- The second day is a bearish candlestick and is larger than the first day.

- The main body of the second day candle completely overwhelms the shadow of the first day candle.

Usually the bearish engulfing candle pattern is considered as a three outside down pattern. The difference is that there is a third more bearish candlestick and the price closes at the bottom of the second bearish candlestick.

2. Dark Cloud Cover (covered with dark clouds)

The Dark Cloud Cover, also known as the Bearish Piercing Line, is a pattern that shows a trend reversal. The first day of the pattern is a long bullish candle, the second day is a bearish candlestick with the opening above the close of the first day's candle and> 50% of the first day's close.

3. Evening Star (star day)

The first day is a long bullish candlestick, the second day has a small body + the gap is higher (the opening price of the second candle is higher than the closing price of the first day), the third day falls sharply and the closing price is within the body of the first candle. 2 could be a Doji candle. It is better to have a gap between the 2nd and 3rd candles.

4. Shooting Star (shooting star candle pattern)

Shooting Star model is also called reverse hammer pattern, signaling a downtrend. According to technical analysis, the star candlestick pattern is a cluster of two candles, the first day is a bullish candlestick and the second day is the true shooting star candle. The shooting star pattern consists of a small real body at the bottom with a long upper shadow, short lower shadow or none. The body of the candle can increase or decrease, the signal will be better if the body of the star shooting is higher than the previous body. The upper shadow must be at least 2 times bigger than the body.

5. Three Inside Down

Three Inside Down is a Bearish Harami pattern with an upward trend, a long bullish candlestick, the second candlestick is a bearish candlestick with a small real body that opens and closes inside the real body of the first day's candlestick. The third is a bearish candlestick that closes below the second day's candlestick.

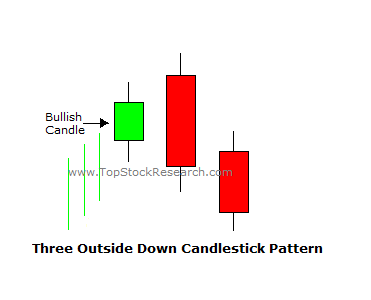

6. Three Outside Down

Three Outside Down is a Bearish Engulfing pattern that has a bullish confirmation with a bearish third day candle, which adds to the reversal reliability of the pattern. The market is in an uptrend. The first day is a bullish candlestick with a small real body. The second day is a bearish candlestick with a large real body opening and closing outside the real body of the first day. The third day is a bearish candlestick with the lower close of the second day.

7. Three Black Crows (model of 3 black crows)

The candlestick pattern of three black crows appears after a rising trend. Each candle in the pattern is a bearish candlestick that closes close to the lowest price in the same candle. The opening price of each candle in the pattern is inside the previous body. A rare variation of the pattern of three black crows is that all 3 candles have the opening price equal to the closing price of the previous candle.

Combine analysis of reversal candlestick patterns with support and resistance levels for best results. And remember, not every reversal candlestick pattern or a continuation pattern will inevitably occur! You need to always consider the market situation and price fluctuations. This is the forex market and nothing is for sure!

0 Comments