What is Elliott wave? Elliott wave is one of the most widely used and popular forms of technical analysis today. Let's explore the entire Elliott wave theory from beginner to advanced.

Introduction to the Elliott wave theory

The Elliott wave principle was discovered by Ralph Nelson Elliott in the 1930s. At the time, Mr. Elliott realized that the stock markets did not behave in a chaotic manner but fluctuated in a certain order according to the The periodic repetition reflects the actions and emotions of human beings caused by external influences or crowd psychology.

Elliott explained that the fluctuations of the psychology of the crowd always showed the same repetitive patterns according to different segments that later, when dividing those segments he had given to its name is "wavelengths" whereby Elliott explores the segmented nature of market action. He was able to analyze the markets in more depth, identify the specific characteristics of wave patterns and make detailed market forecasts based on the wave patterns he identified.

Elliott's research laid the foundations for people like Bolton, Frost and Prechter on which they made profit predictions. not just in stock markets but all other markets.

Elliott wave theory describes the natural rhythm of market psychology, expressing the essence through wave forms. Basically, the Elliott wave assumes that price movement between pushes sets the trend, and corrective phases retrace the trend. "

The basic Elliott wave pattern

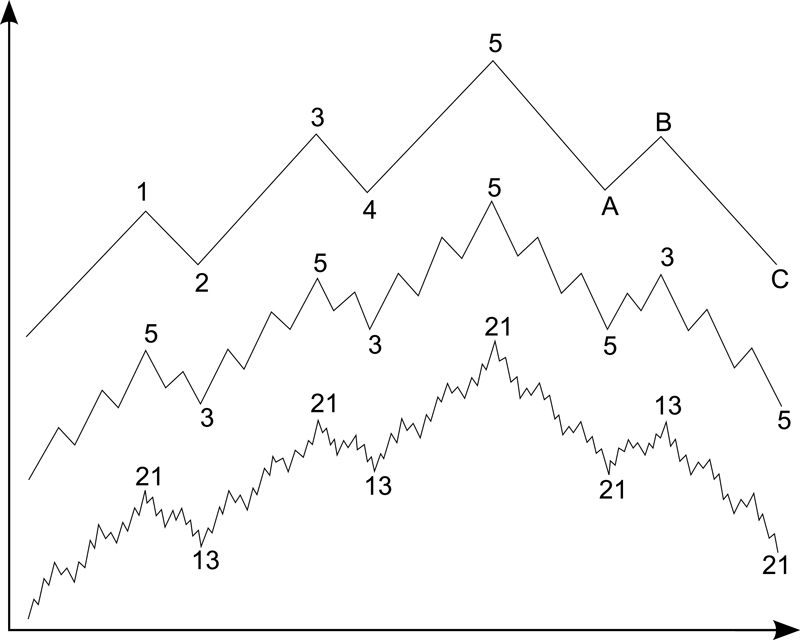

According to Elliott theory, the change of price will create waves as shown below:

In which a basic wave model will have 5 main waves (impulsive waves) numbered by 1-2-3-4-5 and 3 corrective waves (corrective waves) numbered by the letter A-B-C. Of the 5 main waves, waves 1, 3 and 5 are called "active and active" waves (motive waves), and waves 2 and 4 are called "active and corrected" waves (corrective waves). In each of these waves there are small waves and also follow the rules of the Elliot wave theory. A complete master wave will have 89 waves and a complete corrective wave will have 55 waves.

All in all, the complete 8-wave pattern forms a typical Elliott wave structure. That model can go upward (ascending) in bull market speculation (bull market) or descending (descending) in speculative market price down. If the main trend is up, then we will see 5 upswing waves followed by 3 downwards. If the main trend is down, we will see the 5 downward wavelengths followed by the 3 upswing corrections correcting the main trend.

Rules of the basic Elliott wave pattern

To fully understand the Elliott wave theory, it is necessary to understand the market sentiment at each wavelength since the zigzag price fluctuations represent changes in the optimistic or pessimistic psychology of investors.

Below is a psychological analysis of the typical 8-wave pattern of bull market. In bear market, the opposite analysis.

Master wave 1: This first wave has a point of departure from the bull market (recession), so wave 1 is seldom recognized at the beginning. At this time, basic information is still negative information. The trend of the market before the first wave occurs is still the market downturn. Trading volume has increased slightly in the direction of price increases. However, this price increase is negligible. Therefore many technical analysts do not recognize the presence of this wave 1.

Master wave 2: Wave 2 will adjust wave 1, but the lowest point of wave 2 will never surpass the first point of wave 1. The news for the market is not positive. The market goes down at the end of wave 2 to perform a "test" of market lows. The people who follow the trend of price speculation are still convinced that the market is speculating on the price trend. The trading volume will be less than the first wave. The price will be adjusted downward and is usually in the range of 0.382 to 0.618 of the highest of wave 1.

Master wave 3: Usually this is the largest and most powerful wave of an uptrend. At the beginning of wave 3, the market was still receiving negative information so many investors were not ready to buy. When wave 3 is in the middle, the market started to receive positive fundamentals. Despite small adjustments in the heart of wave 3, the price of wave 3 increases at a fairly fast rate. The highest point of wave 3 is usually higher than the highest point of wave 1 with a rate of 1,618 or even 261.8%.

Master wave 4: This is truly a corrective wave. Prices tend to go down and can sometimes create long-lasting aliasing. Wave 4 will usually correct wave 3 with the level of 0.382 - 0.618 of wave 3. The trading volume of wave 4 is lower than the volume of wave 3. This is the time to buy if the investors are aware of the potential. then wave 5. However, recognizing wave 4's stop is one of the difficulties of Elliott wave-field technical analysts.

Master wave 5: This is the last wave of 5 "owner" waves. Positive information spread throughout the market and everyone believed that the market was in a speculative price position. The trading volume of wave 5 is quite large, but it is usually smaller than wave 3. It is worth mentioning that "non-professional" investors often buy in the points near the end of wave 5. At the end of wave 5, The market quickly changed direction. The highest point of wave 5 is higher than the highest point of wave 3 with a rate of 161.8%.

Correction wave A: This wave is the beginning of corrective wave A - B - C. During the time of wave A, basic information is still very optimistic. Despite the falling prices, most investors still believe that the market is in an uptrend. Trading volume grows steadily according to wave A. Wave A usually returns from 38.2% to 61.8% compared to wave 5.

Correction wave B: The price bounced back and is higher than the end of wave A. Wave B is considered an extension of a bull market. For those who follow the classical technical analysis, point B is the right shoulder of the Head and Shoulder graph model. The trading volume of wave B is usually lower than that of wave A. At this time, the basic information does not have new positive points, but has not transferred to negative. Wave B usually returns from 38.2% to 61.8% compared to wave A.

Correction wave C: Prices tend to fall faster than previous waves. Trading volume increased. Almost all investors are well aware of the dominance of the bearish trend in the market, at the latest in the third small wave of wave C. Wave C is usually as big as wave A or often open. 1.618 times wider than wave A or more.

Rules for counting Elliott waves

- Rule 1: Wave 2 is never 100% return from wave 1. In other words, wave 2 should not pass the starting point of wave 1.

- Rule 2: Wave 4 never returns 100% compared to wave 3. In other words, wave 4 should not cross the starting point of wave 3.

- Rule 3: Wave 4 never lies below the top of wave 1.

- Rule 4: In waves 1-3-5, wave 3 is always the longest wave.

Advanced Elliott - Complex Elliott wave patterns

The study of wave patterns is important to correctly apply the Elliott wave principle. A correctly defined market price trend model will not only tell you how much the market price will increase or decrease, but will also show how the market trend is taking place.

When you can identify models and apply them correctly, you can trade on the Elliott wave principle. This is not easy but successful after studying step by step and meticulously with the motto "slowly but surely", you will find it easier.

Complex Elliott wave models include the following:

I. Trends:

1. Impulse model: IP

2. Extension model: ES

3. Leading Diagonal Triangle model

4. Ending Diagonal Triangle Model

5. Failure or Truncated 5th model

II. Correction processes (Corrections):

1. Zigzag model

2. Flat pattern

3. Triangle model

- Contracting Triangle

- Expanding Triangle

4. The model combines Double Three and Triple Three

>> Details of complex Elliott wave models are analyzed in detail in the "Elliott wave theory .pdf"down here. Please unlock and download the document.

0 Comments